Rather than diminishing over time, global shipping and freight delays are worsening on many routes, in the lead up to the busiest time of year: Christmas. Source: IndustryEdge

With retailer’s order books completed, many are now scrambling to ensure they get sufficient capacity on vessels and their supply chain has enough shipping containers to get the ordered goods onto their shelves for what is expected to be the busiest Christmas ever.

In the last few weeks, IndustryEdge has spoken with clients in the wood products and paper sectors whose messages are essentially the same. In the supply constrained structural wood products sector, orders made now will take until Christmas to arrive from western Europe and Scandinavia – at best.

For paper and paperboard, where there are far less supply constraints, commercial customers are being advised that an order in August will take until late January or early February to be delivered from the same regions, and not much less from Asia.

Some supply constraints aside, the main challenge is the continuing asymmetry in global shipping: containers are not well balanced, even when vessels are in the right places and heading where they are needed. That is creating congestion in unlikely places.

As an example, clients have said that recently that Auckland is so congested, some vessels are bypassing that port and heading instead to Tauranga.

Shipping and freight are a mess right now, with the likelihood of more settled waters still being some way off.

The China Consolidated Freight Index (CCFI) shows the cost of shipping finished goods from China around the world continues to increase. Importantly, this is not merely a Chinese phenomenon, but the CCFI represents more container movements than any other index, so gives a fair indication of absolute shipping costs.

Since the start of 2021, the Composite Index has lifted 79.6% – meaning the cost of shipping is around that much higher on average than it was just seven months ago.

To Europe, the cost of shipping has increased an absurd 123% over that period. For Australia and New Zealand – where the proxy route is Shanghai to Melbourne, the CCFI reports the increases are a more modest 53.5%.

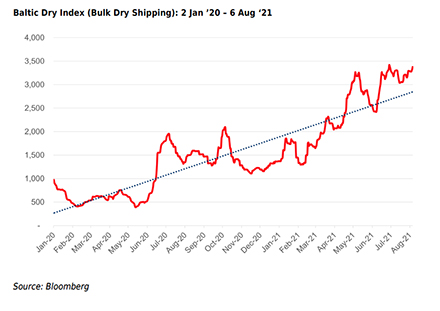

The last month saw the Baltic Dry Index (BDI), the main indices of raw materials shipping costs, remaining above 3,200 points for more than a month and reaching heights not seen since the end of the GFC in mid-2010On a trend basis – the chart here now shows a linear trend line – the BDI may be due for a modest correction, but perhaps not below 3,000 points in 2H’21.